What is a Real Property Report (RPR)?

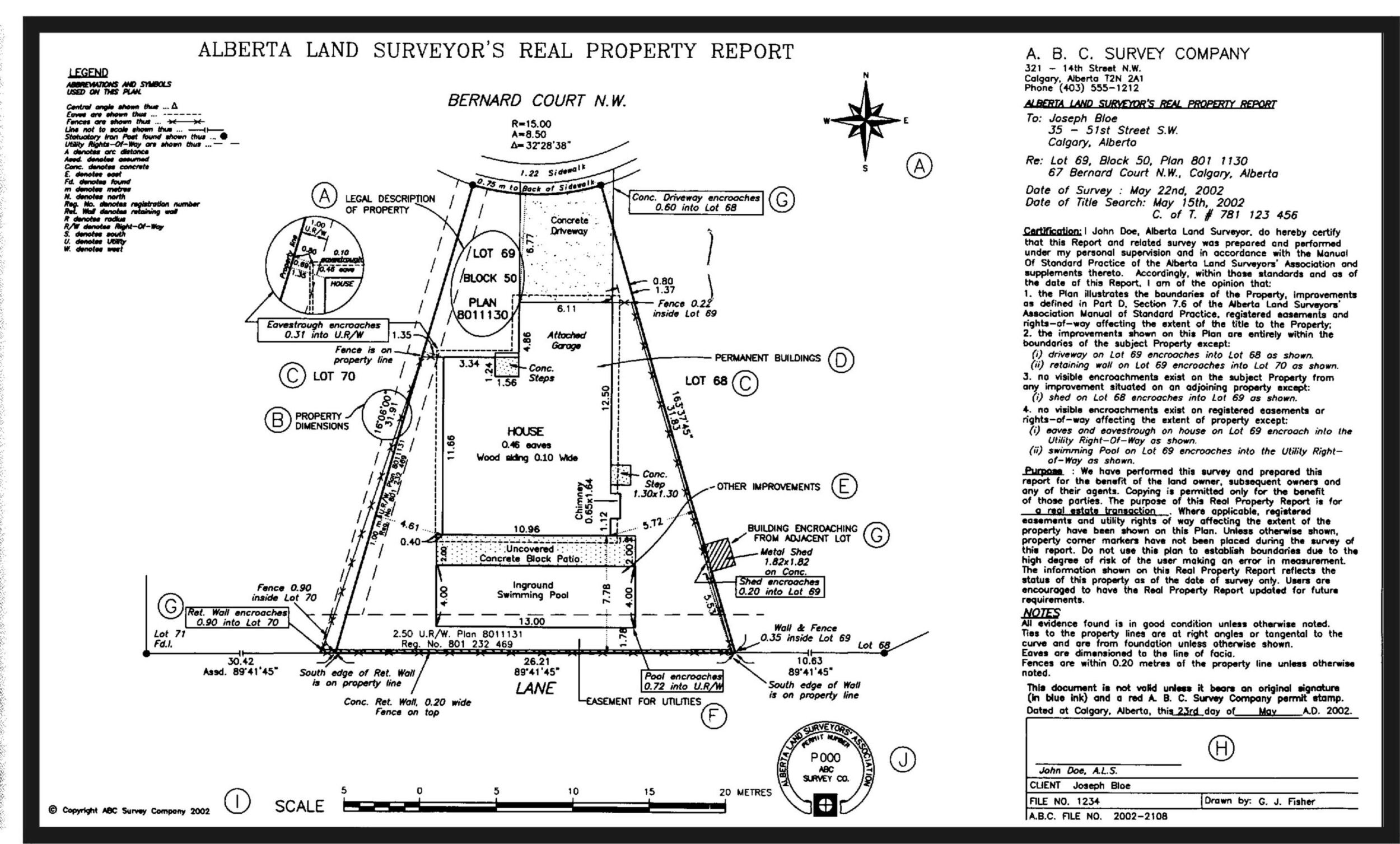

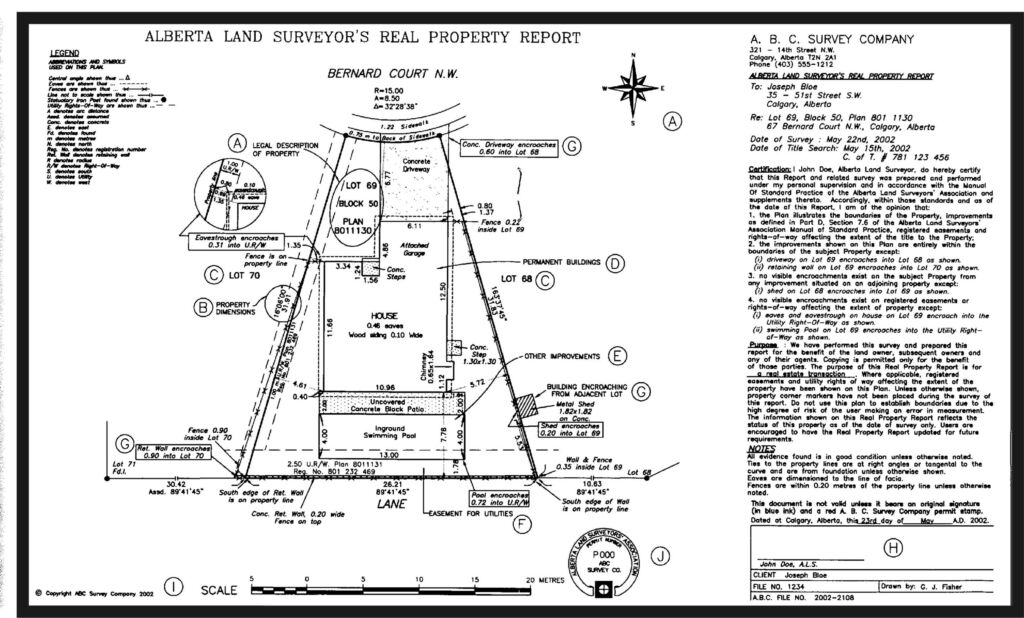

A Real Property Report, usually called an RPR, is a survey prepared by an Alberta Land Surveyor that shows where your home and improvements sit on your lot.

Think of it as a snapshot of your property that answers questions like:

• Where are the property lines?

• Is the fence actually on your lot?

• Is the deck too close to the boundary?

• Does anything cross onto a neighbour’s land (or vice versa)?

Along with a clear diagram, the report also includes the surveyor’s professional observations.

Short version: it’s the document that confirms everything is where it should be — and that’s a very big deal when you’re buying or selling a home.

Why does an RPR matter?

Property boundaries are a legal issue, not a “looks about right” situation.

An RPR helps identify things like:

• Encroachments

• Structures built too close to lot lines

• Bylaw or compliance concerns

• Issues that could delay or complicate a sale

Simply put, it’s a document that helps prevent unpleasant surprises at the worst possible time — right before closing.

Who actually needs one?

In a real estate transaction, almost everyone involved relies on this report.

Sellers – An RPR is required in most resale transactions and helps avoid closing delays or disputes.

Buyers – It confirms the structures and improvements are properly positioned.

Lenders & Lawyers – Often needed before financing and closing can proceed.

Municipality – Reviews the report to determine compliance with local bylaws.

What does an RPR show?

A Real Property Report typically outlines:

• Property dimensions and boundaries

• House location

• Garages, decks, sheds, fences, and other improvements

• Easements or rights-of-way

• Visible encroachments

• Surveyor certification

In other words, all the physical features that affect the lot.

How does a Real Property Report protect you?

For many people, a home purchase is the largest financial investment they will ever make. Because of that, knowing exactly where structures sit in relation to property lines is incredibly important.

An RPR can reveal whether:

• A structure is too close to a boundary

• An improvement crosses onto neighbouring land

• A neighbouring structure encroaches onto the property

Without this clarity, problems may only surface when a property is being sold, which is never ideal.

How long is an RPR valid?

An RPR is a snapshot in time.

If nothing has changed on the property, an existing report can often be updated rather than replaced. However, if you’ve added improvements such as:

• Deck

• Fence

• Garage

• Shed

• Air conditioning unit or pad

• Any attached structure like a gazebo or privacy wall

… an update or new report may be required.

Rule of thumb: no changes = valid for 10 years (or longer), changes = review recommended.

When should a seller deal with this?

Early. Always early.

Waiting until you have a buyer is one of the most common causes of stress and closing delays. If an issue exists – for example, a fence encroachment – it is far better to discover it before you are days away from possession.

What does an RPR cost?

Costs vary depending on lot size, property complexity, and location. In Edmonton, most typical residential reports start around $600 and up.

Updating an existing report is sometimes less expensive, although not significantly.

Who prepares an RPR?

Only a registered Alberta Land Surveyor can legally prepare a Real Property Report.

A valid report must include their signed certification and permit stamp.

What about municipal compliance?

This is the part many people find confusing.

After the surveyor prepares the RPR, it is usually submitted to the municipality for a compliance review. At that stage, the city confirms whether structures meet setback and bylaw regulations.

No compliance stamp can create problems for lenders and lawyers, which is why this step matters.

In Edmonton, compliance requests are handled through the city:

https://www.edmonton.ca/programs_services/service-compliance-residential-commercial.aspx

Important detail: digital submissions must be original copies directly from the surveyor. Copies are not accepted.

My practical advice

If you’re selling:

✔ Order or review your RPR as early as possible

✔ Update it if you’ve made improvements

✔ Do not assume an old survey will work

✔ Avoid last-minute surprises

This is one of those boring documents that quietly prevents very un-boring problems later.

Where does Title Insurance fit into all of this?

Title insurance and an RPR are related, but they serve very different purposes.

An RPR confirms the physical placement of structures and boundaries.

Title insurance, on the other hand, is a policy that protects against certain ownership or title-related risks.

In some situations, when a seller cannot provide an RPR with municipal compliance, a buyer’s lawyer may accept title insurance as an alternative.

However, the two are not interchangeable.

What Title Insurance can help with

Depending on the policy, title insurance may provide protection for:

• Unknown encroachments

• Boundary issues

• Certain title defects

• Fraud or registration concerns

Because of this, it is often used to help keep transactions moving when documentation becomes complicated.

What Title Insurance does not do

Title insurance has limits.

It does not:

✘ Correct property problems

✘ Move structures or fences

✘ Confirm bylaw compliance

✘ Replace an RPR in every scenario

It is protection — not a fix.

Why many sellers still provide an RPR

Even though title insurance is common, most resale contracts still require an RPR with compliance.

Buyers, lenders, and lawyers generally prefer clarity over insurance coverage. Knowing the property complies with municipal rules reduces risk for everyone involved.

My practical take

Title insurance is extremely useful and very common. What’s interesting is how strongly opinions about it tend to shift depending on which side of the transaction you’re on.

In competitive seller’s markets, buyers are usually more flexible and title insurance is widely accepted. In slower or buyer-leaning markets, purchasers often become far more particular, and a current RPR suddenly feels non-negotiable.

Then comes the part that confuses people.

When you’re selling, your lawyer will almost always suggest offering title insurance. Yet when you’re buying, that same professional may strongly advise you to insist on an RPR.

No wonder clients feel like they’re getting mixed messages.

The reality is that title insurance is best viewed as:

✔ A safety net

✔ A risk-management tool

✔ A perfectly reasonable solution in certain situations

NOT:

✔ A substitute for understanding property boundaries

✔ A fix for known issues

✔ A reason to ignore an RPR when one is available

Whenever possible, clarity beats coverage.